The Community Investment Tax Credit (CITC) program is funded by the State of Maryland and reflects the State’s support for 501c3 nonprofit organizations. It allows qualified nonprofits to use state tax credits as an incentive for donations.

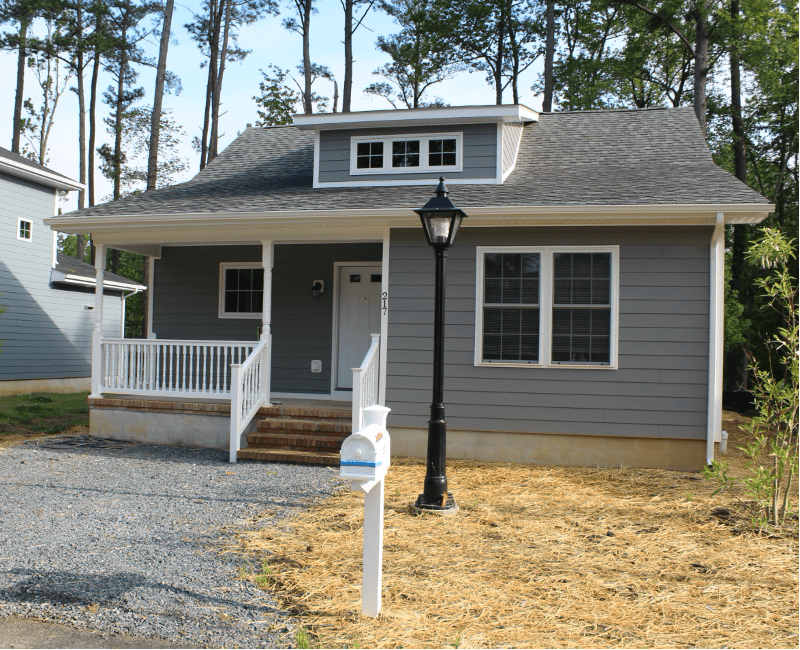

Habitat Choptank applied to the Department of Housing and Community Development’s CITC program and was accepted for our construction of nine homes on Wells Street in the Historic Pine Street District. Donors make monetary gifts to Habitat Choptank to fund the construction, and in turn, the donor receives tax credits that can be claimed at tax return time.

Here’s how the CITC program works:

- Tax credits equal 50% of the value of the donation.

- Minimum gift is $500.

- Tax credits are in addition to deductions on both Federal and State taxes for a charitable contribution.

- Tax credits must be used in the year in which the donation is made.

- Tax credits are on a first come, first served basis and are limited.

- Call Habitat Choptank to express interest. If there are credits available, we will provide you with a required donor waiver form that must be completed along with the gift.

The table below illustrates the benefit to the donor.

| CITC Tax Benefits to an Individual Donor Illustrative $1,000 Donation |

|

| Donation to Habitat Choptank | $1,000 |

| CITC State Tax Credit | ($500) |

| Federal Charitable Tax Deduction | ($320)* |

| MD Charitable Tax Deduction | ($55)* |

| Net Cost of $1,000 Donation | $125 |

| This table is for illustrative purposes, only, and assumes a state tax rate of 5.5% and a federal tax rate of 32%, as well as an itemized deduction scenario. You should consult a tax professional to determine how this program might impact your tax situation. | |

Visit the Maryland Gives page to see the kinds of projects that are being funded across the state!

If you are interested in this giving opportunity, contact Habitat Choptank by calling 410-476-3204 or emailing info@habitatchoptank.org to see if there are credits available. We will provide you with a required donor waiver that must be completed along with the gift.